One issue that comes up in nearly every estate planning exercise with two or more children is whether the children should receive their inheritance in a single testamentary trust for all children (and ultimately grandchildren) or via a separate testamentary trust for each child.

I call it the ‘single versus multi TT’ problem.

The ‘no-brainer’ case for multiple testamentary trusts

Not all willmakers actually have the liberty of choosing how many testamentary trusts to use – for instance, if the family has adult children where the relationship between children is so poor that it is difficult to get everyone to sit around the same table at Christmas, then leaving the inheritance to those children via a single testamentary trust is destined to fail.

The ‘no-brainer’ case for a single testamentary trust

Another general rule of thumb is that where children are minors and there is likely to be an extended period of time where independent parties (such as family members or friends) will manage the inheritance until the children reach financial maturity, then leaving the inheritance to all children via a single testamentary trust can reduce the administration burden on the trustees and keep the investment portfolio together.

I often encourage clients with young children to use a single testamentary trust (starting immediately on the death of the first spouse – see Estate planning for couples: When should a testamentary trust start?) and suggest they revisit their wills once their children have reached financial maturity to consider if the will should be upgraded to incorporate a testamentary trust for each child (i.e. changing to a multiple testamentary trust strategy).

A single trust can often provide better asset protection from family law exposure of the beneficiaries, as it is much easier to rebut any ‘alter ego’ arguments applied against a particular beneficiary where several controllers manage the trust for multiple children and their respective families. For this reason, where the relationship between the children is quite close, I often see families opt for a single trust for all children to access the best possible asset protection from relationship breakdown exposure. I won’t delve any deeper into this point in this post, as it is quite a detailed and evolving area of law.

What if the situation is not clear cut?

The decision about the number of trusts to use is often more complicated where the children are adults with a close relationship, or nearing adulthood but have not quite left the family nest and started living their own autonomous lives.

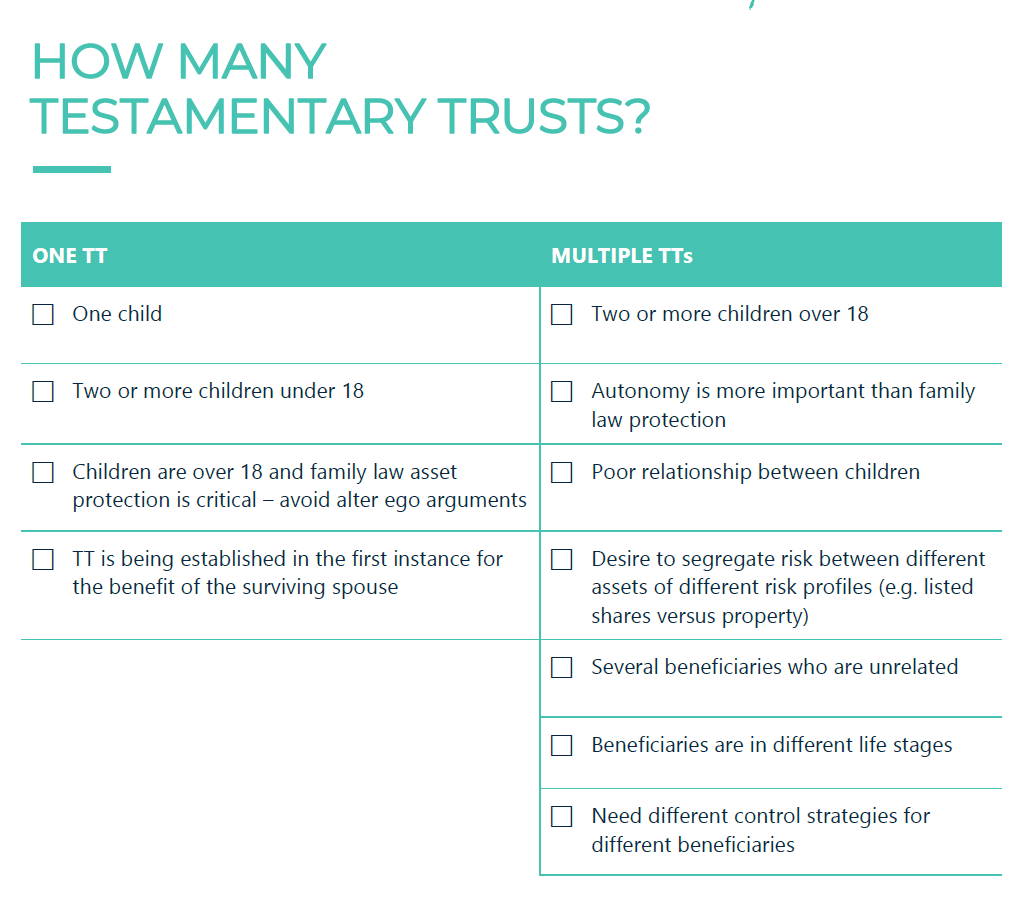

As usual, while it will always depend on the willmakers’ specific circumstances, here is a handy table which sets out some guidelines for whether to use single or multiple testamentary trusts (extracted from our Estate Planning Cheat Sheets):

In essence, it comes down to balancing increased family law protection provided by a single testamentary trust against the autonomy that is afforded by each child receiving their own testamentary trust.

As mentioned above, when crafting an estate plan it is always prudent to try to ‘future proof’ the strategy to make it sufficiently robust, however, it can get very complicated and stall decision making when we try to look into the crystal ball and contemplate children passing through several different life stages. For instance, many willmakers with very young children incorporate a single testamentary trust in their wills now and then revise their wills to incorporate multiple trusts once some of the children have reached 18. If this is not done or the willmakers pass away leaving a single trust and it is later determined that multiple trusts are required, then provided the trust deed contains the appropriate splitting powers, it is possible for the single trust to be split into multiple trusts. That said, starting with the end in mind and choosing the appropriate number of trusts is always much simpler.

Another overlaying factor is whether or not there is a benefit in the testamentary trust coming into operation immediately on the death of one spouse or after both spouses have died. If the intention is to proceed with multiple trusts which commence when the first spouse dies, there could be quite a lengthy period of time where the surviving spouse is maintaining assets in multiple trusts and bearing the administration costs and responsibility of equalizing the assets in each trust ultimately earmarked for their children.

Finally, where children require autonomy over their inheritance, but asset protection is also important, a hybrid approach can be taken to assist in mitigating the ‘alter ego’ arguments. Under a hybrid approach, a testamentary trust can be established for each child, however the child nominated to be the main beneficiary of the testamentary trust is not the sole trustee – i.e. co-trustees are appointed to act jointly with the nominated beneficiary to share control (for example, other family members, siblings or independent friends of the family). This approach can go some way to increasing family law protection while still permitting autonomy for each trust.

Ultimately, there are no rules, and the right outcome will be determined by weighing up the willmakers’ priorities and values for the family to determine what structure will work best for their unique family dynamic.